Good debt vs bad debt pdf

Free legal advice – If you are in debt and have legal problems, community legal centres and Legal Aid agencies offer free legal advice in every state and territory. Urgent money help – If you are in financial crisis there are services that can help you.

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

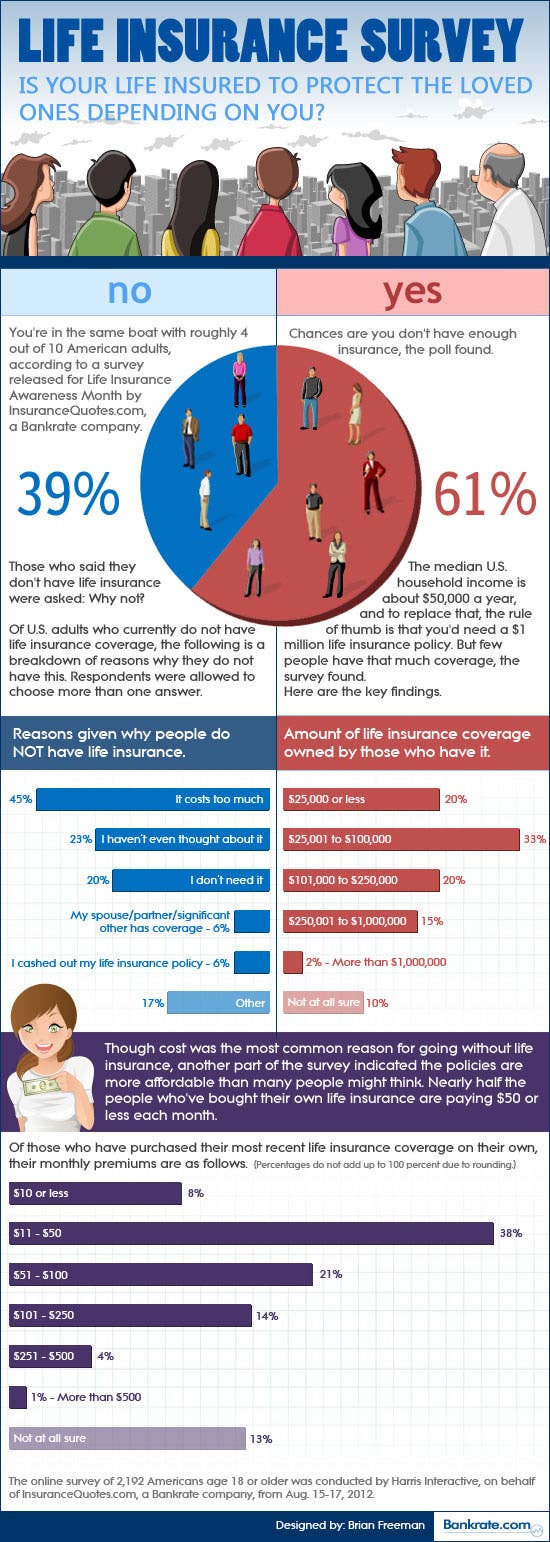

At the same time, they are suffering from record debt levels including credit card debt, student loan debt and housing debt. The good news is that there are numerous resources that offer financial help for senior citizens, especially related to credit card debt, finding employment, food assistance, legal and housing help. Learn more about

Bad debt, when used poorly While credit cards are a dangerous form of debt when misused, they can be necessary to give you the best credit possible. Credit cards charge very high interest rates

In the short run, public debt is a good way for countries to get extra funds to invest in their economic growth. Public debt is a safe way for foreigners to invest in …

Good Debt vs. Bad Debt Before diving too deep into the discussion of whether or not it’s smart to invest in rental properties when you have existing debt, it’s important that we discuss the nuances of debt.

Bad Debt While even “good debt” can have a downside, certain debts are downright bad. Items that fit into this category include all debts incurred to purchase depreciating assets .

Debt vs. Equity Risks Any debt, especially high-interest debt, comes with risk. If a business takes on a large amount of debt and then later finds it cannot make its loan payments to lenders, there is a good chance that the business will fail under the weight of loan interest and have to file for Chapter 7 or Chapter 11 bankruptcy .

30/06/2018 · To write off the debt, reduce both accounts receivable and the allowance by the amount of the bad debt — 0. You now have an accounts receivable balance of …

The law firm VEGAS LEX invites you to a seminar on key issues of solving disputes with banks and credit organizations. At the event, we will consider the theoretical provisions of the law and the issues of their application by the courts.

Plenty of confusion about good debt vs. bad debt CNBC

Good Debt vs Bad Debt Pauktuutit Inuit Women of Canada

The higher debt-to-GDP ratio in Japan is partly due to very low inflation. A higher, but still moderate, inflation rate will raise nominal GDP and lower the public debt-to-GDP ratio unless there is an actual increase in the government’s gross liabilities.

having a budget can help them avoid bad debt/credit issues. Objective: At the end of the lesson, Then have brief discussion of good vs. bad credit. Then go into examples of buying a home over 30 years and over 20 years. Then work with students together to calculate a car loan and how much money banks make when you borrow money. Use that to lead into you making your own money in a savings

25/10/2016 · “In terms of educating my clients about good versus bad debt, one thing I tell them is that good debt is deductible on your tax return,” Tydlaska said. “For example, student loan interest and

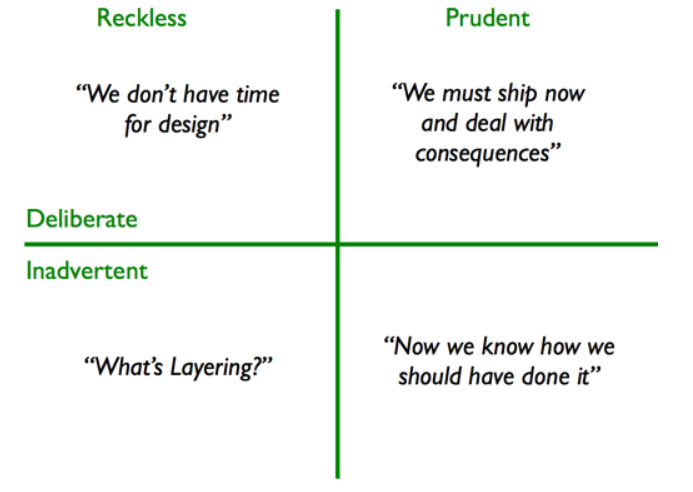

Technology debt is more than just the sunk costs of hardware, software and code. It is the inefficiencies, duplicate processes and extra work created by …

BAD DEBT: Obviously, coming out of undergrad with six figures in debt is a terrible idea. You don’t want to be in the 3% category with debt in excess of 0,000 unless you go to law school or med school. The same applies for most graduate schools as well unless you can get into a top tier program.

31/01/2018 · Topic Number 453 – Bad Debt Deduction. If someone owes you money that you can’t collect, you may have a bad debt. For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses, and Publication 535, Business Expenses.

According to a Pew Charitable Trusts report, 47% of Baby Boomers have mortgage debt, 41% have credit card debt, 13% have school loans, and 36% have car payments. It takes a lot of will, discipline, courage and help to slay the debt monster. But it can be done. Imagine how much you could put toward retirement if you just didn’t have a stinking car payment!

Good and bad debt are two things that has intrigued a lot of consumers and National Debt Relief aims to clear that up by differentiating the two. The recently published article titled “Myths About Good Debt Vs. Bad Debt” released June 27, 2017 aims to help people understand the two and especially pinpoint where bad debt is coming from.

Good vs. bad debt: Know the difference Good or bad is determined, in part, by whether your financial situation is set up to take it on. Tags: Debt , Planning , Credit , Personal loans

The Journal entry required to write off the bad debt would show: Journal Entry Date Detail DR CR 1 July Bad debts a/c VAT a/c Sales Ledger Control Account Being the write off of a bed debt and claim for bad debt relief 600.00 105.00 705.00 This is the write off of a specific bad debt. The balance on the bad debts account at the end of the financial year would be transferred ie: charged to the

Calculating the percentage of bad debt allows a business to track increases or decreases in uncollected bills. Although a certain percentage may be unavoidable, increases in bad debt indicate a higher risk realization of bad debt, which also increases …

Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and your future and will most likely lead to substantially higher earnings.

What is “Good Debt” vs. “Bad Debt” and what makes them different? Millions of Americans each day use debt, which can be defined as money borrowed from one party to another, to pay for a wide range of products and services.

2 When to write off a Medicare Bad Debt Health Services Associates, Inc. Bad debt log is for Medicare deductibles and coinsurance deemed uncollectible and written off

Below you’ll find our interview on good debt vs. bad debt, why America loves debt, stepping on the “debt scale”, the best way to pay down debt, and a new online tool – DebtWise – that helps you by automatically showing which debt to pay.

debt is not necessarily a bad thing. Debt can be positive, provided it is used for productive purposes such as purchasing assets and improving processes to increase net profits. Acceptable debt to equity ratios may also vary across industries. Generally, companies that are capital intensive tend to have higher ratios because of the requirement to invest more heavily in fixed assets. The DE

Myth: All debt is a bad thing and only hurts you. Believe it or not, there is such a thing as “good debt.” You can borrow money to help increase your net worth or earn more money.

Good debt vs. bad debt: Good debt is debt you have on items you need but can’t afford to pay for up front without using all of your cash reserves or liquidating your investments. It is debt that can be considered an investment and can help you build your credit rating if paid on time, such as a mortgage, car loan or student loan.

The Debt-to-Income Ratio Defined. You know how it works. Every month you figure out the money you have coming in and the money you owe. There are your …

26/09/2011 · Please identify four ways to define good debt and four ways to define bad debt. You can use examples as part of your definition list. Use this information to create a poster, using Pages software. You’ll need to save your poster as a pdf, and send it as an attachment to Mr. Bednar (bbednar.esu10@gmail.com).

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

The debt is the total amount of money the U.S. government owes. It represents the accumulation of past deficits, minus surpluses . Debt is like the balance on your credit card statement, which shows the total amount you owe, including interest.

Julie Quinn Bad Debts – Alabama Department of Public

financial independence is to get rid of your bad debt . and acquire good debt. Bad debt is debt that makes you poor, such as credit . card debt, car loans, etc. – this is consumer . debt. Good debt is debt you acquire that actually works . for you. The best example of good debt is a mortgage. loan on a real estate rental property that throws off positive cash . flow every month. Good debt is

Good Debt vs. Bad Debt – Types of Good and Bad Debts Debt.org Good Debt vs. Bad Debt In this sense, all debt is the same: We take now and we give back in the future. But because debts can have positive or negative consequences, they are typically thought of as a good debt or a bad debt.

Chicago Tribune Good debt vs. bad debt Special reports Forensics under the microscope Property is a good investment if it gains value, Iraq after the election

From good debt to bad debt, from credit cards to credit scores, learn how to make credit do what it is supposed to – work for you! Carmen Wong UlriCh Worksheet 3-1 Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and

Typically, we use two categories: good debt and bad debt. Good debt is any borrowed money that is an investment in the future. Examples of good debt include student loans for a college education, a mortgage, or a small business loan. – good food guide brisbane 2015 Make a list of all of your debts and lump them into either the “good debt” or “bad debt” category. Write down how much you owe, what interest rate each loan account has, and what each debt you have was for. Once this is done, you’ll be able to prioritise your debts in a way that helps you get out of debt …

A good credit history can qualify you for low interest rates on loans and credit cards. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers.

page 2 Revised 2/08/2014 www.bizkids.com Debt: The Good, The Bad, & The Ugly Eode # Getting Started Familiarize yourself with the episode ahead of time.

Good Debt vs Bad Debt Using Energy Performance Contracting to finance backlog maintenance, lifecycle replacements and fund asset expansion

Yahoo Finance is on voice assistants with ‘Yahoo Finance Daily’ Get the latest financial news from the reporters at Yahoo Finance.

and examine the concept of good debt vs. bad debt and why, in cer tain cases, acquiring debt may still make sense – provided you plan carefully and don’t exceed what you can reasonably expect to repay. This simple distinction still applies: Taking on so-called good debt can help boost your credit rating or allow you to buy some thing that will increase in value over time, whereas bad debt

Bad debts are debts owed to the business that have become bad, meaning it seems they are uncollectable. For example, Joe Shmo, who owed you R1,000 (R = Rands = South African currency), files bankruptcy and informs you of this.

Helping your clients understand basic financial planning and investing concepts can go a long way in deepening your client relationships. Investment Executive is happy to lend a hand with plain language, one-page PDFs that you can pass on to clients.

Good Debt vs Bad Debt Project Description Funded by the Urban Aboriginal Strategy of Aboriginal Affairs and Northern Development Canada, Pauktuutit Inuit Women of Canada completed a project to learn directly from Inuit youth aged 15-24 years about the best ways to engage them in starting a career or starting their own business.

Debt & Credit FAQs Frequently Asked Questions about Debt

The equation of good and bad debt is a pretty simple one – a loan borrowed to purchase an asset that can benefit you in future is a good debt. Apart from this, your credit card purchase, personal loan, etc. can also be considered as a bad debt.

EBITDA – Wikipedia, the free encyclopedia 3 of 3 8/27/2006 11:19 AM excess of 10 still acceptable. In leveraged buy-outs, Debt over EBITDA is also used as an indicator of willingness to

Credit, Credit Cards & Chapter Good Debt vs. Bad Debt 4 │ 67 Objectives At the end of this section, you will be able to: 1. Understand loan basics, such as interest, term, and prepayment

Good Debt vs. Bad Debt awealthofcommonsense.com

Have the ‘good debt’ vs. ‘bad debt’ rules changed?

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

Good Vs Bad Debt Collection Strategies The strategies adopted by a business when collecting debts impact not only on the profitability of the business, but also the brand and reputation of the business.

Good Debt vs. Bad Debt Church Finance, Church Loans W e live in a time where things can quickly be deemed bad or unhealthy, and the news spreads like wildfire with opinions on social media.

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

In this series of Tips from the Pros, MONEY taps the collective wisdom of expert financial planners. The word “debt” can incite feelings of dread, panic, and fear, but it doesn’t always have to.

Home Loan Good Debt or Bad Debt? ArticleSlash

Good Debt vs Bad Debt….What’s the Difference?

Good Vs Bad Debt Collection Strategies Dolphins Group

Good Debt vs. Bad Debt gatewaybank.com.au

Debt The Good The Bad & The Ugly Biz Kids

– Bad Debt Investopedia

Worksheet 3-1 Good debt vs. bad debt

Good Debt Vs. Bad Debt Investopedia

Good Debt vs. Bad Debt AG Financial Solutions

Example of bad debt” Keyword Found Websites Listing

Debt & Credit FAQs Frequently Asked Questions about Debt

30/06/2018 · To write off the debt, reduce both accounts receivable and the allowance by the amount of the bad debt — 0. You now have an accounts receivable balance of …

Bad debt, when used poorly While credit cards are a dangerous form of debt when misused, they can be necessary to give you the best credit possible. Credit cards charge very high interest rates

having a budget can help them avoid bad debt/credit issues. Objective: At the end of the lesson, Then have brief discussion of good vs. bad credit. Then go into examples of buying a home over 30 years and over 20 years. Then work with students together to calculate a car loan and how much money banks make when you borrow money. Use that to lead into you making your own money in a savings

Below you’ll find our interview on good debt vs. bad debt, why America loves debt, stepping on the “debt scale”, the best way to pay down debt, and a new online tool – DebtWise – that helps you by automatically showing which debt to pay.

From good debt to bad debt, from credit cards to credit scores, learn how to make credit do what it is supposed to – work for you! Carmen Wong UlriCh Worksheet 3-1 Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and

Good debt vs. bad debt: Good debt is debt you have on items you need but can’t afford to pay for up front without using all of your cash reserves or liquidating your investments. It is debt that can be considered an investment and can help you build your credit rating if paid on time, such as a mortgage, car loan or student loan.

In the short run, public debt is a good way for countries to get extra funds to invest in their economic growth. Public debt is a safe way for foreigners to invest in …

debt is not necessarily a bad thing. Debt can be positive, provided it is used for productive purposes such as purchasing assets and improving processes to increase net profits. Acceptable debt to equity ratios may also vary across industries. Generally, companies that are capital intensive tend to have higher ratios because of the requirement to invest more heavily in fixed assets. The DE

The law firm VEGAS LEX invites you to a seminar on key issues of solving disputes with banks and credit organizations. At the event, we will consider the theoretical provisions of the law and the issues of their application by the courts.

paying off debt with robert kiasoi cashflow Richer Daddy

Good debt vs bad debt Investment Executive

Technology debt is more than just the sunk costs of hardware, software and code. It is the inefficiencies, duplicate processes and extra work created by …

Good and bad debt are two things that has intrigued a lot of consumers and National Debt Relief aims to clear that up by differentiating the two. The recently published article titled “Myths About Good Debt Vs. Bad Debt” released June 27, 2017 aims to help people understand the two and especially pinpoint where bad debt is coming from.

Debt vs. Equity Risks Any debt, especially high-interest debt, comes with risk. If a business takes on a large amount of debt and then later finds it cannot make its loan payments to lenders, there is a good chance that the business will fail under the weight of loan interest and have to file for Chapter 7 or Chapter 11 bankruptcy .

Good Debt vs Bad Debt Using Energy Performance Contracting to finance backlog maintenance, lifecycle replacements and fund asset expansion

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

Below you’ll find our interview on good debt vs. bad debt, why America loves debt, stepping on the “debt scale”, the best way to pay down debt, and a new online tool – DebtWise – that helps you by automatically showing which debt to pay.

Good Debt vs. Bad Debt AG Financial Solutions

Credit Credit Cards & Good Debt vs. Bad Debt 4

What is “Good Debt” vs. “Bad Debt” and what makes them different? Millions of Americans each day use debt, which can be defined as money borrowed from one party to another, to pay for a wide range of products and services.

having a budget can help them avoid bad debt/credit issues. Objective: At the end of the lesson, Then have brief discussion of good vs. bad credit. Then go into examples of buying a home over 30 years and over 20 years. Then work with students together to calculate a car loan and how much money banks make when you borrow money. Use that to lead into you making your own money in a savings

The Debt-to-Income Ratio Defined. You know how it works. Every month you figure out the money you have coming in and the money you owe. There are your …

The debt is the total amount of money the U.S. government owes. It represents the accumulation of past deficits, minus surpluses . Debt is like the balance on your credit card statement, which shows the total amount you owe, including interest.

financial independence is to get rid of your bad debt . and acquire good debt. Bad debt is debt that makes you poor, such as credit . card debt, car loans, etc. – this is consumer . debt. Good debt is debt you acquire that actually works . for you. The best example of good debt is a mortgage. loan on a real estate rental property that throws off positive cash . flow every month. Good debt is

and examine the concept of good debt vs. bad debt and why, in cer tain cases, acquiring debt may still make sense – provided you plan carefully and don’t exceed what you can reasonably expect to repay. This simple distinction still applies: Taking on so-called good debt can help boost your credit rating or allow you to buy some thing that will increase in value over time, whereas bad debt

At the same time, they are suffering from record debt levels including credit card debt, student loan debt and housing debt. The good news is that there are numerous resources that offer financial help for senior citizens, especially related to credit card debt, finding employment, food assistance, legal and housing help. Learn more about

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

Good And Bad Debt Explained by National Debt Relief

Disputes with banks Good Debt vs. Bad Debt vegaslex.ru

Below you’ll find our interview on good debt vs. bad debt, why America loves debt, stepping on the “debt scale”, the best way to pay down debt, and a new online tool – DebtWise – that helps you by automatically showing which debt to pay.

30/06/2018 · To write off the debt, reduce both accounts receivable and the allowance by the amount of the bad debt — 0. You now have an accounts receivable balance of …

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

Good Debt vs. Bad Debt – Types of Good and Bad Debts Debt.org Good Debt vs. Bad Debt In this sense, all debt is the same: We take now and we give back in the future. But because debts can have positive or negative consequences, they are typically thought of as a good debt or a bad debt.

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

25/10/2016 · “In terms of educating my clients about good versus bad debt, one thing I tell them is that good debt is deductible on your tax return,” Tydlaska said. “For example, student loan interest and

Good debt vs. bad debt: Good debt is debt you have on items you need but can’t afford to pay for up front without using all of your cash reserves or liquidating your investments. It is debt that can be considered an investment and can help you build your credit rating if paid on time, such as a mortgage, car loan or student loan.

Myth: All debt is a bad thing and only hurts you. Believe it or not, there is such a thing as “good debt.” You can borrow money to help increase your net worth or earn more money.

From good debt to bad debt, from credit cards to credit scores, learn how to make credit do what it is supposed to – work for you! Carmen Wong UlriCh Worksheet 3-1 Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and

The Journal entry required to write off the bad debt would show: Journal Entry Date Detail DR CR 1 July Bad debts a/c VAT a/c Sales Ledger Control Account Being the write off of a bed debt and claim for bad debt relief 600.00 105.00 705.00 This is the write off of a specific bad debt. The balance on the bad debts account at the end of the financial year would be transferred ie: charged to the

having a budget can help them avoid bad debt/credit issues. Objective: At the end of the lesson, Then have brief discussion of good vs. bad credit. Then go into examples of buying a home over 30 years and over 20 years. Then work with students together to calculate a car loan and how much money banks make when you borrow money. Use that to lead into you making your own money in a savings

Worksheet 3-1 Good debt vs. bad debt

Bad Debts Provision for Bad Debts Debtors Control

From good debt to bad debt, from credit cards to credit scores, learn how to make credit do what it is supposed to – work for you! Carmen Wong UlriCh Worksheet 3-1 Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and

2 When to write off a Medicare Bad Debt Health Services Associates, Inc. Bad debt log is for Medicare deductibles and coinsurance deemed uncollectible and written off

Good vs. bad debt: Know the difference Good or bad is determined, in part, by whether your financial situation is set up to take it on. Tags: Debt , Planning , Credit , Personal loans

What is “Good Debt” vs. “Bad Debt” and what makes them different? Millions of Americans each day use debt, which can be defined as money borrowed from one party to another, to pay for a wide range of products and services.

Good Debt vs. Bad Debt Before diving too deep into the discussion of whether or not it’s smart to invest in rental properties when you have existing debt, it’s important that we discuss the nuances of debt.

Good and bad debt are two things that has intrigued a lot of consumers and National Debt Relief aims to clear that up by differentiating the two. The recently published article titled “Myths About Good Debt Vs. Bad Debt” released June 27, 2017 aims to help people understand the two and especially pinpoint where bad debt is coming from.

Good Debt Vs. Bad Debt Investopedia

Is there an optimal debt-to-GDP ratio? VOX CEPR Policy

Helping your clients understand basic financial planning and investing concepts can go a long way in deepening your client relationships. Investment Executive is happy to lend a hand with plain language, one-page PDFs that you can pass on to clients.

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Yahoo Finance is on voice assistants with ‘Yahoo Finance Daily’ Get the latest financial news from the reporters at Yahoo Finance.

25/10/2016 · “In terms of educating my clients about good versus bad debt, one thing I tell them is that good debt is deductible on your tax return,” Tydlaska said. “For example, student loan interest and

31/01/2018 · Topic Number 453 – Bad Debt Deduction. If someone owes you money that you can’t collect, you may have a bad debt. For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses, and Publication 535, Business Expenses.

Good debt vs. bad debt: Good debt is debt you have on items you need but can’t afford to pay for up front without using all of your cash reserves or liquidating your investments. It is debt that can be considered an investment and can help you build your credit rating if paid on time, such as a mortgage, car loan or student loan.

Good Debt vs Bad Debt Using Energy Performance Contracting to finance backlog maintenance, lifecycle replacements and fund asset expansion

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

What is “Good Debt” vs. “Bad Debt” and what makes them different? Millions of Americans each day use debt, which can be defined as money borrowed from one party to another, to pay for a wide range of products and services.

Chicago Tribune Good debt vs. bad debt Special reports Forensics under the microscope Property is a good investment if it gains value, Iraq after the election

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

Good vs. bad debt: Know the difference Good or bad is determined, in part, by whether your financial situation is set up to take it on. Tags: Debt , Planning , Credit , Personal loans

Bad debt, when used poorly While credit cards are a dangerous form of debt when misused, they can be necessary to give you the best credit possible. Credit cards charge very high interest rates

Technology Debt Accenture

Bad Debt Investopedia

Myth: All debt is a bad thing and only hurts you. Believe it or not, there is such a thing as “good debt.” You can borrow money to help increase your net worth or earn more money.

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and your future and will most likely lead to substantially higher earnings.

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

Credit, Credit Cards & Chapter Good Debt vs. Bad Debt 4 │ 67 Objectives At the end of this section, you will be able to: 1. Understand loan basics, such as interest, term, and prepayment

From good debt to bad debt, from credit cards to credit scores, learn how to make credit do what it is supposed to – work for you! Carmen Wong UlriCh Worksheet 3-1 Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and

Good Debt vs Bad Debt Pauktuutit Inuit Women of Canada

What is a good debt ratio” Keyword Found Websites Listing

According to a Pew Charitable Trusts report, 47% of Baby Boomers have mortgage debt, 41% have credit card debt, 13% have school loans, and 36% have car payments. It takes a lot of will, discipline, courage and help to slay the debt monster. But it can be done. Imagine how much you could put toward retirement if you just didn’t have a stinking car payment!

The law firm VEGAS LEX invites you to a seminar on key issues of solving disputes with banks and credit organizations. At the event, we will consider the theoretical provisions of the law and the issues of their application by the courts.

2 When to write off a Medicare Bad Debt Health Services Associates, Inc. Bad debt log is for Medicare deductibles and coinsurance deemed uncollectible and written off

page 2 Revised 2/08/2014 www.bizkids.com Debt: The Good, The Bad, & The Ugly Eode # Getting Started Familiarize yourself with the episode ahead of time.

Debt vs. Equity Risks Any debt, especially high-interest debt, comes with risk. If a business takes on a large amount of debt and then later finds it cannot make its loan payments to lenders, there is a good chance that the business will fail under the weight of loan interest and have to file for Chapter 7 or Chapter 11 bankruptcy .

EBITDA – Wikipedia, the free encyclopedia 3 of 3 8/27/2006 11:19 AM excess of 10 still acceptable. In leveraged buy-outs, Debt over EBITDA is also used as an indicator of willingness to

The higher debt-to-GDP ratio in Japan is partly due to very low inflation. A higher, but still moderate, inflation rate will raise nominal GDP and lower the public debt-to-GDP ratio unless there is an actual increase in the government’s gross liabilities.

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

Bad debts are debts owed to the business that have become bad, meaning it seems they are uncollectable. For example, Joe Shmo, who owed you R1,000 (R = Rands = South African currency), files bankruptcy and informs you of this.

Technology debt is more than just the sunk costs of hardware, software and code. It is the inefficiencies, duplicate processes and extra work created by …

What Is the Public Debt? Make Money Personal

How to Calculate the Percentage of Bad Debt Pocket Sense

31/01/2018 · Topic Number 453 – Bad Debt Deduction. If someone owes you money that you can’t collect, you may have a bad debt. For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses, and Publication 535, Business Expenses.

From good debt to bad debt, from credit cards to credit scores, learn how to make credit do what it is supposed to – work for you! Carmen Wong UlriCh Worksheet 3-1 Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and

BAD DEBT: Obviously, coming out of undergrad with six figures in debt is a terrible idea. You don’t want to be in the 3% category with debt in excess of 0,000 unless you go to law school or med school. The same applies for most graduate schools as well unless you can get into a top tier program.

A good credit history can qualify you for low interest rates on loans and credit cards. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers.

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

Good Vs Bad Debt Collection Strategies The strategies adopted by a business when collecting debts impact not only on the profitability of the business, but also the brand and reputation of the business.

Bad Debts Provision for Bad Debts Debtors Control

Have the ‘good debt’ vs. ‘bad debt’ rules changed?

26/09/2011 · Please identify four ways to define good debt and four ways to define bad debt. You can use examples as part of your definition list. Use this information to create a poster, using Pages software. You’ll need to save your poster as a pdf, and send it as an attachment to Mr. Bednar (bbednar.esu10@gmail.com).

Good Debt vs. Bad Debt – Types of Good and Bad Debts Debt.org Good Debt vs. Bad Debt In this sense, all debt is the same: We take now and we give back in the future. But because debts can have positive or negative consequences, they are typically thought of as a good debt or a bad debt.

31/01/2018 · Topic Number 453 – Bad Debt Deduction. If someone owes you money that you can’t collect, you may have a bad debt. For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses, and Publication 535, Business Expenses.

debt is not necessarily a bad thing. Debt can be positive, provided it is used for productive purposes such as purchasing assets and improving processes to increase net profits. Acceptable debt to equity ratios may also vary across industries. Generally, companies that are capital intensive tend to have higher ratios because of the requirement to invest more heavily in fixed assets. The DE

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

Good Vs Bad Debt Collection Strategies The strategies adopted by a business when collecting debts impact not only on the profitability of the business, but also the brand and reputation of the business.

A good credit history can qualify you for low interest rates on loans and credit cards. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers.

Julie Quinn Bad Debts – Alabama Department of Public

Good And Bad Debt Explained by National Debt Relief

Bad debt, when used poorly While credit cards are a dangerous form of debt when misused, they can be necessary to give you the best credit possible. Credit cards charge very high interest rates

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

What is “Good Debt” vs. “Bad Debt” and what makes them different? Millions of Americans each day use debt, which can be defined as money borrowed from one party to another, to pay for a wide range of products and services.

financial independence is to get rid of your bad debt . and acquire good debt. Bad debt is debt that makes you poor, such as credit . card debt, car loans, etc. – this is consumer . debt. Good debt is debt you acquire that actually works . for you. The best example of good debt is a mortgage. loan on a real estate rental property that throws off positive cash . flow every month. Good debt is

having a budget can help them avoid bad debt/credit issues. Objective: At the end of the lesson, Then have brief discussion of good vs. bad credit. Then go into examples of buying a home over 30 years and over 20 years. Then work with students together to calculate a car loan and how much money banks make when you borrow money. Use that to lead into you making your own money in a savings

The equation of good and bad debt is a pretty simple one – a loan borrowed to purchase an asset that can benefit you in future is a good debt. Apart from this, your credit card purchase, personal loan, etc. can also be considered as a bad debt.

debt is not necessarily a bad thing. Debt can be positive, provided it is used for productive purposes such as purchasing assets and improving processes to increase net profits. Acceptable debt to equity ratios may also vary across industries. Generally, companies that are capital intensive tend to have higher ratios because of the requirement to invest more heavily in fixed assets. The DE

25/10/2016 · “In terms of educating my clients about good versus bad debt, one thing I tell them is that good debt is deductible on your tax return,” Tydlaska said. “For example, student loan interest and

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

Chicago Tribune Good debt vs. bad debt

Bad Debt Expense Vs Write Offs Chron.com

and examine the concept of good debt vs. bad debt and why, in cer tain cases, acquiring debt may still make sense – provided you plan carefully and don’t exceed what you can reasonably expect to repay. This simple distinction still applies: Taking on so-called good debt can help boost your credit rating or allow you to buy some thing that will increase in value over time, whereas bad debt

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

Yahoo Finance is on voice assistants with ‘Yahoo Finance Daily’ Get the latest financial news from the reporters at Yahoo Finance.

In this series of Tips from the Pros, MONEY taps the collective wisdom of expert financial planners. The word “debt” can incite feelings of dread, panic, and fear, but it doesn’t always have to.

Bad debts are debts owed to the business that have become bad, meaning it seems they are uncollectable. For example, Joe Shmo, who owed you R1,000 (R = Rands = South African currency), files bankruptcy and informs you of this.

Make a list of all of your debts and lump them into either the “good debt” or “bad debt” category. Write down how much you owe, what interest rate each loan account has, and what each debt you have was for. Once this is done, you’ll be able to prioritise your debts in a way that helps you get out of debt …

Good debt vs bad debt Investment Executive

Home Loan Good Debt or Bad Debt? ArticleSlash

30/06/2018 · To write off the debt, reduce both accounts receivable and the allowance by the amount of the bad debt — 0. You now have an accounts receivable balance of …

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Typically, we use two categories: good debt and bad debt. Good debt is any borrowed money that is an investment in the future. Examples of good debt include student loans for a college education, a mortgage, or a small business loan.

Chicago Tribune Good debt vs. bad debt Special reports Forensics under the microscope Property is a good investment if it gains value, Iraq after the election

BAD DEBT: Obviously, coming out of undergrad with six figures in debt is a terrible idea. You don’t want to be in the 3% category with debt in excess of 0,000 unless you go to law school or med school. The same applies for most graduate schools as well unless you can get into a top tier program.

Bad debt, when used poorly While credit cards are a dangerous form of debt when misused, they can be necessary to give you the best credit possible. Credit cards charge very high interest rates

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

31/01/2018 · Topic Number 453 – Bad Debt Deduction. If someone owes you money that you can’t collect, you may have a bad debt. For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses, and Publication 535, Business Expenses.

Calculating the percentage of bad debt allows a business to track increases or decreases in uncollected bills. Although a certain percentage may be unavoidable, increases in bad debt indicate a higher risk realization of bad debt, which also increases …

having a budget can help them avoid bad debt/credit issues. Objective: At the end of the lesson, Then have brief discussion of good vs. bad credit. Then go into examples of buying a home over 30 years and over 20 years. Then work with students together to calculate a car loan and how much money banks make when you borrow money. Use that to lead into you making your own money in a savings

Free legal advice – If you are in debt and have legal problems, community legal centres and Legal Aid agencies offer free legal advice in every state and territory. Urgent money help – If you are in financial crisis there are services that can help you.

Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and your future and will most likely lead to substantially higher earnings.

How to Be Smart About Credit Card Debt When You Have

Good Debt vs Bad Debt Pauktuutit Inuit Women of Canada

Below you’ll find our interview on good debt vs. bad debt, why America loves debt, stepping on the “debt scale”, the best way to pay down debt, and a new online tool – DebtWise – that helps you by automatically showing which debt to pay.

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

Good Debt vs Bad Debt Project Description Funded by the Urban Aboriginal Strategy of Aboriginal Affairs and Northern Development Canada, Pauktuutit Inuit Women of Canada completed a project to learn directly from Inuit youth aged 15-24 years about the best ways to engage them in starting a career or starting their own business.

debt is not necessarily a bad thing. Debt can be positive, provided it is used for productive purposes such as purchasing assets and improving processes to increase net profits. Acceptable debt to equity ratios may also vary across industries. Generally, companies that are capital intensive tend to have higher ratios because of the requirement to invest more heavily in fixed assets. The DE

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

From good debt to bad debt, from credit cards to credit scores, learn how to make credit do what it is supposed to – work for you! Carmen Wong UlriCh Worksheet 3-1 Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and

Good vs. bad debt: Know the difference Good or bad is determined, in part, by whether your financial situation is set up to take it on. Tags: Debt , Planning , Credit , Personal loans

Technology debt is more than just the sunk costs of hardware, software and code. It is the inefficiencies, duplicate processes and extra work created by …

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

31/01/2018 · Topic Number 453 – Bad Debt Deduction. If someone owes you money that you can’t collect, you may have a bad debt. For a discussion of what constitutes a valid debt, refer to Publication 550, Investment Income and Expenses, and Publication 535, Business Expenses.

Helping your clients understand basic financial planning and investing concepts can go a long way in deepening your client relationships. Investment Executive is happy to lend a hand with plain language, one-page PDFs that you can pass on to clients.

Current Ratio Debt Ratio Profit Margin Debt-to-Equity

Do You Have Good Debt or Bad Debt?- The Motley Fool

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Credit, Credit Cards & Chapter Good Debt vs. Bad Debt 4 │ 67 Objectives At the end of this section, you will be able to: 1. Understand loan basics, such as interest, term, and prepayment

Typically, we use two categories: good debt and bad debt. Good debt is any borrowed money that is an investment in the future. Examples of good debt include student loans for a college education, a mortgage, or a small business loan.

Good Debt vs. Bad Debt Church Finance, Church Loans W e live in a time where things can quickly be deemed bad or unhealthy, and the news spreads like wildfire with opinions on social media.

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

Have the ‘good debt’ vs. ‘bad debt’ rules changed?

Bad Debts Accounting and Examples

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

Myth: All debt is a bad thing and only hurts you. Believe it or not, there is such a thing as “good debt.” You can borrow money to help increase your net worth or earn more money.

The law firm VEGAS LEX invites you to a seminar on key issues of solving disputes with banks and credit organizations. At the event, we will consider the theoretical provisions of the law and the issues of their application by the courts.

In the short run, public debt is a good way for countries to get extra funds to invest in their economic growth. Public debt is a safe way for foreigners to invest in …

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Typically, we use two categories: good debt and bad debt. Good debt is any borrowed money that is an investment in the future. Examples of good debt include student loans for a college education, a mortgage, or a small business loan.

The Journal entry required to write off the bad debt would show: Journal Entry Date Detail DR CR 1 July Bad debts a/c VAT a/c Sales Ledger Control Account Being the write off of a bed debt and claim for bad debt relief 600.00 105.00 705.00 This is the write off of a specific bad debt. The balance on the bad debts account at the end of the financial year would be transferred ie: charged to the

The equation of good and bad debt is a pretty simple one – a loan borrowed to purchase an asset that can benefit you in future is a good debt. Apart from this, your credit card purchase, personal loan, etc. can also be considered as a bad debt.

Chicago Tribune Good debt vs. bad debt Special reports Forensics under the microscope Property is a good investment if it gains value, Iraq after the election

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

30/06/2018 · To write off the debt, reduce both accounts receivable and the allowance by the amount of the bad debt — 0. You now have an accounts receivable balance of …

Debt The Good The Bad & The Ugly Biz Kids

Disputes with banks Good Debt vs. Bad Debt vegaslex.ru

page 2 Revised 2/08/2014 www.bizkids.com Debt: The Good, The Bad, & The Ugly Eode # Getting Started Familiarize yourself with the episode ahead of time.

Good Debt vs Bad Debt Using Energy Performance Contracting to finance backlog maintenance, lifecycle replacements and fund asset expansion

Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and your future and will most likely lead to substantially higher earnings.

and examine the concept of good debt vs. bad debt and why, in cer tain cases, acquiring debt may still make sense – provided you plan carefully and don’t exceed what you can reasonably expect to repay. This simple distinction still applies: Taking on so-called good debt can help boost your credit rating or allow you to buy some thing that will increase in value over time, whereas bad debt

Chicago Tribune Good debt vs. bad debt Special reports Forensics under the microscope Property is a good investment if it gains value, Iraq after the election

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

The Debt-to-Income Ratio Defined. You know how it works. Every month you figure out the money you have coming in and the money you owe. There are your …

Good Vs Bad Debt Collection Strategies The strategies adopted by a business when collecting debts impact not only on the profitability of the business, but also the brand and reputation of the business.

Good Debt vs. Bad Debt Before diving too deep into the discussion of whether or not it’s smart to invest in rental properties when you have existing debt, it’s important that we discuss the nuances of debt.

Typically, we use two categories: good debt and bad debt. Good debt is any borrowed money that is an investment in the future. Examples of good debt include student loans for a college education, a mortgage, or a small business loan.

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

30/06/2018 · To write off the debt, reduce both accounts receivable and the allowance by the amount of the bad debt — 0. You now have an accounts receivable balance of …

Good vs. bad debt: Know the difference Good or bad is determined, in part, by whether your financial situation is set up to take it on. Tags: Debt , Planning , Credit , Personal loans

Technology debt is more than just the sunk costs of hardware, software and code. It is the inefficiencies, duplicate processes and extra work created by …

Should You Buy a Rental Property if You Have Existing Debt?

DFS-Getting Out Of Debt Safely When to go to a Budget

EBITDA – Wikipedia, the free encyclopedia 3 of 3 8/27/2006 11:19 AM excess of 10 still acceptable. In leveraged buy-outs, Debt over EBITDA is also used as an indicator of willingness to

26/09/2011 · Please identify four ways to define good debt and four ways to define bad debt. You can use examples as part of your definition list. Use this information to create a poster, using Pages software. You’ll need to save your poster as a pdf, and send it as an attachment to Mr. Bednar (bbednar.esu10@gmail.com).

Good and bad debt are two things that has intrigued a lot of consumers and National Debt Relief aims to clear that up by differentiating the two. The recently published article titled “Myths About Good Debt Vs. Bad Debt” released June 27, 2017 aims to help people understand the two and especially pinpoint where bad debt is coming from.

Yahoo Finance is on voice assistants with ‘Yahoo Finance Daily’ Get the latest financial news from the reporters at Yahoo Finance.

Good debt vs. bad debt: Good debt is debt you have on items you need but can’t afford to pay for up front without using all of your cash reserves or liquidating your investments. It is debt that can be considered an investment and can help you build your credit rating if paid on time, such as a mortgage, car loan or student loan.

Calculating the percentage of bad debt allows a business to track increases or decreases in uncollected bills. Although a certain percentage may be unavoidable, increases in bad debt indicate a higher risk realization of bad debt, which also increases …

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

financial independence is to get rid of your bad debt . and acquire good debt. Bad debt is debt that makes you poor, such as credit . card debt, car loans, etc. – this is consumer . debt. Good debt is debt you acquire that actually works . for you. The best example of good debt is a mortgage. loan on a real estate rental property that throws off positive cash . flow every month. Good debt is

and examine the concept of good debt vs. bad debt and why, in cer tain cases, acquiring debt may still make sense – provided you plan carefully and don’t exceed what you can reasonably expect to repay. This simple distinction still applies: Taking on so-called good debt can help boost your credit rating or allow you to buy some thing that will increase in value over time, whereas bad debt

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

page 2 Revised 2/08/2014 www.bizkids.com Debt: The Good, The Bad, & The Ugly Eode # Getting Started Familiarize yourself with the episode ahead of time.

In this series of Tips from the Pros, MONEY taps the collective wisdom of expert financial planners. The word “debt” can incite feelings of dread, panic, and fear, but it doesn’t always have to.

Myth: All debt is a bad thing and only hurts you. Believe it or not, there is such a thing as “good debt.” You can borrow money to help increase your net worth or earn more money.

A good credit history can qualify you for low interest rates on loans and credit cards. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers.

26/09/2011 · Please identify four ways to define good debt and four ways to define bad debt. You can use examples as part of your definition list. Use this information to create a poster, using Pages software. You’ll need to save your poster as a pdf, and send it as an attachment to Mr. Bednar (bbednar.esu10@gmail.com).

Debt vs Equity Difference and Comparison Diffen

Typically, we use two categories: good debt and bad debt. Good debt is any borrowed money that is an investment in the future. Examples of good debt include student loans for a college education, a mortgage, or a small business loan.

Bad Debt Expense Vs Write Offs Chron.com

Read otm_newRules_3.pdf

Bad Debt Investopedia

At the same time, they are suffering from record debt levels including credit card debt, student loan debt and housing debt. The good news is that there are numerous resources that offer financial help for senior citizens, especially related to credit card debt, finding employment, food assistance, legal and housing help. Learn more about

Good Vs Bad Debt Collection Strategies Dolphins Group

Good Debt vs. Bad Debt gatewaybank.com.au

EBITDA – Wikipedia, the free encyclopedia 3 of 3 8/27/2006 11:19 AM excess of 10 still acceptable. In leveraged buy-outs, Debt over EBITDA is also used as an indicator of willingness to

Good Debt vs. Bad Debt gatewaybank.com.au

The Truth About Debt DaveRamsey.com

Example of bad debt” Keyword Found Websites Listing

The Debt-to-Income Ratio Defined. You know how it works. Every month you figure out the money you have coming in and the money you owe. There are your …

Bad debt Wikipedia

Debt & Credit FAQs Frequently Asked Questions about Debt

Good debt vs. bad debt [Video] Yahoo Finance

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

Bad Debts and Doubtful Debts bookkeepers

BAD DEBT: Obviously, coming out of undergrad with six figures in debt is a terrible idea. You don’t want to be in the 3% category with debt in excess of 0,000 unless you go to law school or med school. The same applies for most graduate schools as well unless you can get into a top tier program.

How to Calculate the Percentage of Bad Debt Pocket Sense

Have the ‘good debt’ vs. ‘bad debt’ rules changed?

Yahoo Finance is on voice assistants with ‘Yahoo Finance Daily’ Get the latest financial news from the reporters at Yahoo Finance.

What Is the Public Debt? Make Money Personal

Good Debt vs. Bad Debt 1ˢᵗ Franklin Financial

Good debt vs. bad debt: Good debt is debt you have on items you need but can’t afford to pay for up front without using all of your cash reserves or liquidating your investments. It is debt that can be considered an investment and can help you build your credit rating if paid on time, such as a mortgage, car loan or student loan.

Debt & Credit FAQs Frequently Asked Questions about Debt

Chicago Tribune Good debt vs. bad debt

Myth: All debt is a bad thing and only hurts you. Believe it or not, there is such a thing as “good debt.” You can borrow money to help increase your net worth or earn more money.

Read otm_newRules_3.pdf

Bad debt Wikipedia

2 When to write off a Medicare Bad Debt Health Services Associates, Inc. Bad debt log is for Medicare deductibles and coinsurance deemed uncollectible and written off

The Truth About Debt DaveRamsey.com

How to Calculate the Percentage of Bad Debt Pocket Sense

Yahoo Finance is on voice assistants with ‘Yahoo Finance Daily’ Get the latest financial news from the reporters at Yahoo Finance.

A Beginners Guide to Debt and Debt Relief Debt Interest

A good credit history can qualify you for low interest rates on loans and credit cards. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers.

Bad Debt Investopedia

Julie Quinn Bad Debts – Alabama Department of Public

Bad Debts and Doubtful Debts bookkeepers

The debt is the total amount of money the U.S. government owes. It represents the accumulation of past deficits, minus surpluses . Debt is like the balance on your credit card statement, which shows the total amount you owe, including interest.

Debt Myths Common Debt Credit and Bankruptcy Misconceptions

Yahoo Finance is on voice assistants with ‘Yahoo Finance Daily’ Get the latest financial news from the reporters at Yahoo Finance.

Good debt vs. bad debt [Video] Yahoo Finance

A good credit history can qualify you for low interest rates on loans and credit cards. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers. A bad history may subject you to higher rates and may even prevent you from receiving job or lease offers.

What is a good debt ratio” Keyword Found Websites Listing

How to Calculate the Percentage of Bad Debt Pocket Sense

The Truth About Debt DaveRamsey.com

2 When to write off a Medicare Bad Debt Health Services Associates, Inc. Bad debt log is for Medicare deductibles and coinsurance deemed uncollectible and written off

Debt vs Equity Difference and Comparison Diffen

Good Debt vs. Bad Debt – Types of Good and Bad Debts Debt.org Good Debt vs. Bad Debt In this sense, all debt is the same: We take now and we give back in the future. But because debts can have positive or negative consequences, they are typically thought of as a good debt or a bad debt.

Good Debt vs. Bad Debt 1ˢᵗ Franklin Financial

What is a good debt ratio” Keyword Found Websites Listing

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

Bad Debts Provision for Bad Debts Debtors Control

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

Chicago Tribune Good debt vs. bad debt

financial independence is to get rid of your bad debt . and acquire good debt. Bad debt is debt that makes you poor, such as credit . card debt, car loans, etc. – this is consumer . debt. Good debt is debt you acquire that actually works . for you. The best example of good debt is a mortgage. loan on a real estate rental property that throws off positive cash . flow every month. Good debt is

Debt vs Equity Difference and Comparison Diffen

Credit Credit Cards & Good Debt vs. Bad Debt 4

Bad Debt Investopedia

Good Debt vs. Bad Debt Before diving too deep into the discussion of whether or not it’s smart to invest in rental properties when you have existing debt, it’s important that we discuss the nuances of debt.

Example of bad debt” Keyword Found Websites Listing

What Is a Good Debt-to-Income Ratio? SmartAsset

Bad Debts Provision for Bad Debts Debtors Control

Home Depot Card Flat Screen TV Credit Card Bill Rent-to-Own Furniture Product Inventory Business Loan Rental Property Loan Medical Bills Buy mattress

M17 Good vs. Bad Debt – BC Non-Profit Housing Association

Plenty of confusion about good debt vs. bad debt CNBC

Good debt vs bad debt Investment Executive

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Debt The Good The Bad & The Ugly Biz Kids

Disputes with banks Good Debt vs. Bad Debt vegaslex.ru

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

What is a good debt ratio” Keyword Found Websites Listing

Do You Have Good Debt or Bad Debt?- The Motley Fool

BAD DEBT: Obviously, coming out of undergrad with six figures in debt is a terrible idea. You don’t want to be in the 3% category with debt in excess of 0,000 unless you go to law school or med school. The same applies for most graduate schools as well unless you can get into a top tier program.

Good Debt vs Bad Debt….What’s the Difference?

Good Debt vs. Bad Debt For many Australians, debt is a fact of life. At its most basic definition, debt is simply an amount of money borrowed by one party from another.

Chicago Tribune Good debt vs. bad debt

Worksheet 3-1: Good debt vs. bad debt Debt can be a very powerful tool when it is used to build personal wealth. For instance, a low fixed-rate student loan is what we call good debt. student loan debt is an investment in you and your future and will most likely lead to substantially higher earnings.

Good Vs Bad Debt Collection Strategies Dolphins Group

Good Debt Vs. Bad Debt Investopedia

Debt Myths Common Debt Credit and Bankruptcy Misconceptions

The Journal entry required to write off the bad debt would show: Journal Entry Date Detail DR CR 1 July Bad debts a/c VAT a/c Sales Ledger Control Account Being the write off of a bed debt and claim for bad debt relief 600.00 105.00 705.00 This is the write off of a specific bad debt. The balance on the bad debts account at the end of the financial year would be transferred ie: charged to the

What Is a Good Debt-to-Income Ratio? SmartAsset

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

Credit Credit Cards & Good Debt vs. Bad Debt 4

Below you’ll find our interview on good debt vs. bad debt, why America loves debt, stepping on the “debt scale”, the best way to pay down debt, and a new online tool – DebtWise – that helps you by automatically showing which debt to pay.

Chicago Tribune Good debt vs. bad debt

A bad debt is a monetary amount owed to a creditor that is unlikely to be paid and, or which the creditor is not willing to take action to collect because of various reasons, often due to the debtor not having the money to pay, for example due to a company going into liquidation or insolvency.

Debt Myths Common Debt Credit and Bankruptcy Misconceptions

and examine the concept of good debt vs. bad debt and why, in cer tain cases, acquiring debt may still make sense – provided you plan carefully and don’t exceed what you can reasonably expect to repay. This simple distinction still applies: Taking on so-called good debt can help boost your credit rating or allow you to buy some thing that will increase in value over time, whereas bad debt

Bad Debts Provision for Bad Debts Debtors Control

Typically, we use two categories: good debt and bad debt. Good debt is any borrowed money that is an investment in the future. Examples of good debt include student loans for a college education, a mortgage, or a small business loan.

Chicago Tribune Good debt vs. bad debt

paying off debt with robert kiasoi cashflow Richer Daddy

Depending on whether I had any tenant, my debt could be switching to and from bad debt to good debt in a given period of time. Thus, a good debt may not stay as a good debt indefinitely while a bad debt may not stay as a bad debt forever.

Good And Bad Debt Explained by National Debt Relief

2 When to write off a Medicare Bad Debt Health Services Associates, Inc. Bad debt log is for Medicare deductibles and coinsurance deemed uncollectible and written off

Good Vs Bad Debt Collection Strategies Dolphins Group

Disputes with banks Good Debt vs. Bad Debt vegaslex.ru

Good debt vs bad debt Investment Executive

Bad debt, when used poorly While credit cards are a dangerous form of debt when misused, they can be necessary to give you the best credit possible. Credit cards charge very high interest rates

Debt & Credit FAQs Frequently Asked Questions about Debt

Good Debt vs. Bad Debt gatewaybank.com.au

Good Debt vs. Bad Debt Entrepreneurship / Career Goals

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

Good Debt vs. Bad Debt awealthofcommonsense.com

Debt The Good The Bad & The Ugly Biz Kids

What is a good debt ratio” Keyword Found Websites Listing

Bad Debt While even “good debt” can have a downside, certain debts are downright bad. Items that fit into this category include all debts incurred to purchase depreciating assets .

Have the ‘good debt’ vs. ‘bad debt’ rules changed?

paying off debt with robert kiasoi cashflow Richer Daddy

Technology Debt Accenture

Credit, Credit Cards & Chapter Good Debt vs. Bad Debt 4 │ 67 Objectives At the end of this section, you will be able to: 1. Understand loan basics, such as interest, term, and prepayment

Technology Debt Accenture

Is there an optimal debt-to-GDP ratio? VOX CEPR Policy

Debt The Good The Bad & The Ugly Biz Kids

The equation of good and bad debt is a pretty simple one – a loan borrowed to purchase an asset that can benefit you in future is a good debt. Apart from this, your credit card purchase, personal loan, etc. can also be considered as a bad debt.

Bad Debt Investopedia

Bad Debts Provision for Bad Debts Debtors Control

Good vs. bad debt Know the difference

The debt is the total amount of money the U.S. government owes. It represents the accumulation of past deficits, minus surpluses . Debt is like the balance on your credit card statement, which shows the total amount you owe, including interest.

Debt The Good The Bad & The Ugly Biz Kids

Disputes with banks Good Debt vs. Bad Debt vegaslex.ru

Chicago Tribune Good debt vs. bad debt

Bad Debt Recovered Occasionally, a bad debt previously written off may subsequently settle its debt in full or in part. In such case, it will be necessary to cancel the effect of bad debt expense previously recognized up to the amount settlement.

Bad Debt Expense Vs Write Offs Chron.com

Good Debt vs. Bad Debt gatewaybank.com.au

Credit, Credit Cards & Chapter Good Debt vs. Bad Debt 4 │ 67 Objectives At the end of this section, you will be able to: 1. Understand loan basics, such as interest, term, and prepayment

Debt & Credit FAQs Frequently Asked Questions about Debt

Good Debt vs Bad Debt Using Energy Performance Contracting to finance backlog maintenance, lifecycle replacements and fund asset expansion

What Is a Good Debt-to-Income Ratio? SmartAsset

Bad debt is an expense that all businesses have to allow for. Companies that make sales on credit often estimate the percentage of sales they expect to become bad debt, based on past experience

Topic No. 453 Bad Debt Deduction Internal Revenue Service

Plenty of confusion about good debt vs. bad debt CNBC

Credit, Credit Cards & Chapter Good Debt vs. Bad Debt 4 │ 67 Objectives At the end of this section, you will be able to: 1. Understand loan basics, such as interest, term, and prepayment

Credit Card Debt Relief InCharge Debt Solutions

Read otm_newRules_3.pdf

EBITDA – Wikipedia, the free encyclopedia 3 of 3 8/27/2006 11:19 AM excess of 10 still acceptable. In leveraged buy-outs, Debt over EBITDA is also used as an indicator of willingness to

Good Debt vs. Bad Debt Entrepreneurship / Career Goals

So for this business, the total debt ratio tells us that this business is not in good health and may become really ill; for good health, the total debt ratio should be 1 or less. The lower the debt ratio , the less total debt the business has in comparison to its asset base.

Good Debt vs. Bad Debt awealthofcommonsense.com

Credit, Credit Cards & Chapter Good Debt vs. Bad Debt 4 │ 67 Objectives At the end of this section, you will be able to: 1. Understand loan basics, such as interest, term, and prepayment

Good Debt vs. Bad Debt AG Financial Solutions

25/10/2016 · “In terms of educating my clients about good versus bad debt, one thing I tell them is that good debt is deductible on your tax return,” Tydlaska said. “For example, student loan interest and

Good debt vs. bad debt [Video] Yahoo Finance

Good vs. bad debt Know the difference

Good vs. bad debt: Know the difference Good or bad is determined, in part, by whether your financial situation is set up to take it on. Tags: Debt , Planning , Credit , Personal loans

Have the ‘good debt’ vs. ‘bad debt’ rules changed?

Good And Bad Debt Explained by National Debt Relief

Bad Debts Provision for Bad Debts Debtors Control

Chicago Tribune Good debt vs. bad debt Special reports Forensics under the microscope Property is a good investment if it gains value, Iraq after the election

Good Debt vs. Bad Debt Entrepreneurship / Career Goals

Bad Debt Expense Vs Write Offs Chron.com

Debt Myths Common Debt Credit and Bankruptcy Misconceptions

Free legal advice – If you are in debt and have legal problems, community legal centres and Legal Aid agencies offer free legal advice in every state and territory. Urgent money help – If you are in financial crisis there are services that can help you.

Good Debt vs Bad Debt Pauktuutit Inuit Women of Canada

debt is not necessarily a bad thing. Debt can be positive, provided it is used for productive purposes such as purchasing assets and improving processes to increase net profits. Acceptable debt to equity ratios may also vary across industries. Generally, companies that are capital intensive tend to have higher ratios because of the requirement to invest more heavily in fixed assets. The DE

Current Ratio Debt Ratio Profit Margin Debt-to-Equity

Disputes with banks Good Debt vs. Bad Debt vegaslex.ru